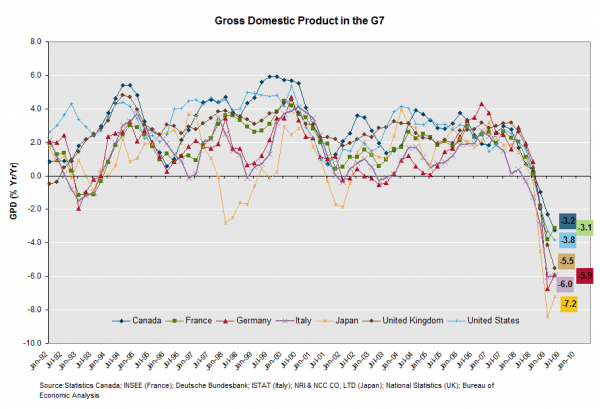

Here is an interesting graph, showing the year-over-year growth of the Gross Domestic Product over the last two decades for the G7 countries, the seven major western economies. You can click on it to see a larger image:

There are several interesting things we can see from this graph:

- The current economic mess started early in 2008, a year before Obama took office (and before he was even expected to win the election). So people who blame this on Obama are either wing-nuts, or just nuts.

- Compared to the economic swings since 1992, this one is pretty bad. But several countries are already starting to come out of it.

- The countries whose economies dropped the most are Japan, Germany, and Italy. These happen to be the countries that went fascist (i.e., far right wing) in WWII. Coincidence?

- The country whose economy fell the least (so far) is Canada. France was next, and it is one of the countries that is starting to recover. These are the most liberal countries in the G7.

- The US GDP did best during the Clinton presidency (92-99), took a hit right after Bush took office in 2000, and then dropped the most during his last year in office. During Obama’s first six months in office, the economic downturn slowed considerably. Based on the recent economic news, I expect it to improve over the next six months.

14 Comments

Hold on – are you trying to link this crisis to pre-WWII decisions? The economies of Germany, Japan, and Italy were completely destroyed during WWII, and when the U.S. helped to rebuild them, they became export-heavy economies in an age of globalism driven by the American consumer. There should be exactly zero surprise that the recession that’s caused the largest hit to global trade since WWII would be particularly harsh for those countries.

I would agree with all of your points, except the WWII fascist link. It’s kind of like when a baseball team is compared to some previous team of the same franchise from 40 years ago (or 4, for that matter).

I thought I worded the third point ambiguously enough. Personally, I think it is a coincidence, but it is still an interesting (and ironic) coincidence.

“The countries whose economies dropped the most are Japan, Germany, and Italy. These happen to be the countries that went fascist (i.e., far right wing) in WWII.”

They’re also the countries with the largest export orientation and – especially in Germany’s case – not of consumer goods, but the high value technology to produce those consumer goods.. Coincidence?

This is reverse causality as in “People are eating a lot of icecream today, which is why it’s so hot”

Information from data

Knowledge from information

You’ve got the “information” bit right, it’s just the conversion to “knowledge” that’s a bit shonky

Sheesh. So how about if I said: “People are eating a lot of ice cream today. And it just so happens that the weather is hot. Coincidence?”

Is that reverse causality? Just because you have a fancy label for something doesn’t mean I’m guilty of it.

Why is everyone so hung up on this one (slightly sarcastic) point? See my post today on the danger of Satire on the Internet.

Icecream/weather. Coincidence? Of course not – it’s transparently obvious.

Used to be right wing. No demand for exports. Coincidence? Don’t silly

People are focusing on this because it’s out of character for your blog. And a bit… transparently dumb.

Flattery will get you everywhere!

The economy does indeed have a liberal bias, as do most real-world entities. It’s characters from religious folklore and neocon revisionist histories that have conservative biases, for self-evident reasons.

The current economic mess has nothing to do with Obama and everything to do with financial deregulation and the housing bubble. It’s short-sighted Americans and the ADD-inducing 24-hour news media that even consider this mess being Obama’s fault.

We’re coming out of this recession as well, technically speaking. It’s in fact most likely over, GDP growth went positive in spring 2009, but unemployment will remain high for the next several years (9.8% through 2010, 8.7% through 2011, by the Fed’s estimates) – the job sectors hit worst in this recession have been in construction and manufacturing, and it’s not like in previous recessions, where those laid off workers are getting their jobs back–the big 3 automakers went bankrupt this time, most of those workers aren’t getting their jobs back, and the housing bubble busted, most of those builders won’t be needed until excess inventories are bought up, which will take several years. Add to that the cumulative effects of global free trade, global outsourcing, and the increasing reliance on automated robots and software to do what we used to pay low-educated workers to do, and you have a bleak picture for employment prospects for the a large swath of our lower-skilled workforce.

It always strikes me as funny when people bad-mouth the ‘socialist’ economies in France and Sweden…it’s completely based on feelings, not facts. Even unemployment in a country like France is nothing like unemployment here–when an American loses his/her job, there’s a much higher level of human suffering and uncertainty than when a Frenchman loses his job.

And the Clinton presidency’s economic successes discredited the Republican claim that tax increases poison economic growth. In fact, ironically enough, Ronald Reagan’s and George H.W. Bush’s tax increases proved the very same point. Unfortunately, the Clinton boom was complicated by the Fed’s loose monetary policy and the occurrence of the tech boom during those years. And so, while we can’t attribute all the growth to Democratic economic policy, we can attribute a substantial portion of it, and moreover we can lay to bed the GOP notion that tax increases (especially on the rich) hurt the economy.

President Obama’s economy will most certainly improve in the next several months, but unemployment will not improve for several years. We needed a bigger stimulus and/or a population patient enough to invest in better education for the nation’s children and a few decades for those children to create/excel in new industries on a globally competitive scale.

I’m curious — in what way are Canada and France “the most liberal” of the G7? By either social or economic measures, I’m not sure this claim holds water…

How about by the number of times that Fox News calls them socialist? 🙂

My only criticism of this is that GDP is not a good indicator of economic activity. It is an outdated measure of macro-scale economic activity focusing exclusively on manufacturing and the production of goods. As John Burland pointed out, this is why export reliant countries like Japan, Germany, and Italy are seeing the largest reduction in their GDP. I’m not sure what John is including in his description of “high value technology to produce those consumer goods”. But, insofar as that technology is in the form of services, GDP would not account for that. In fact, Germany’s biggest export is automobiles (the are the 3rd largest producer of the world’s cars, after the US and Japan). They also export large amounts of chemicals and machine tools, two additional commodities whose demand has declined in the recession.

My point being that GDP sucks as a measure of economic activity.

@starluna. I don’t think GDP is as bad as you may think. It does indeed measure services, as well as goods. It broadly includes everything measurable that people spend their money on, including services like technological services, financial investments, or hospital visits and manufactured goods like houses and automobiles.

I agree with your interpretation of John Burland’s comment, but I disagree in the assertion that GDP isn’t measuring it. Indeed, export-oriented countries like Germany were hit hard this recession because worldwide aggregate demand plummeted for both goods and services, and that demand was being from import-oriented countries like the U.S., which have long been accustomed to GDPs reflective of people buying more than they sell to the rest of the world.

@starluna

The technology that German exports comes from the huge number of SMEs that comprise the core of Germany’s economy. They’re specialist machines that are certainly GDP relevant. Huge exports to Asia of engineering products that were making products for…..the US market

Hermann Simon’s “Hidden Champions” is a good read on the topic.

I agree with StARLUNA. GDP is just one way to measure the state of economy of the whole country. But I will put my personal opinion here. “GDP is a good indicator of economy under ideal conditions i.e. no war, no political sanctions, no embargo, etc. But in real world GDP is not worth anything. The way GDP(nominal) is calculated is way to skewed. But it is also true that GDP based on PPP is very close to the real world economic conditions of a country.

Nominal GDP would increase if you destroy 10000 houses and build the same number of houses again. But this ends with the same amount of houses that was there earlier in the first place. There is no value added, but still GDP increases.

One Trackback/Pingback

[…] trying to blame Obama for the current economic mess (which happened even before Obama was elected), now that the economy is showing signs of recovery, Fox News host Neal Cavuto is trying to give […]