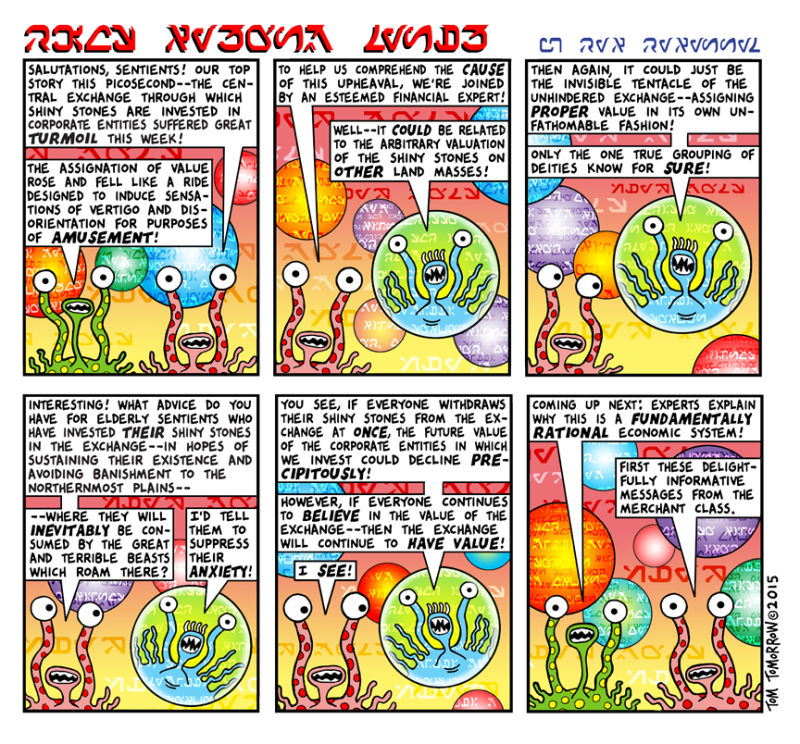

Shhhh! Don’t tell anyone. But the value of everything – stocks, your home, even the value of money – is completely arbitrary. How much anything is worth is based on what someone is willing to pay for it, which is controlled almost completely by emotions like fear and hope. It isn’t rational at all.

And as they say, what goes up must come down. And as long as bankers and realtors make lots of money from people buying and selling, then bubbles aren’t just some anomaly, they are a feature designed to take money out of your pocket and give it to Wall street.

If news about corporations, banks, and speculators buying up rights to fresh water doesn’t scare you, then you aren’t paying attention. Remember the oil crisis? You ain’t seen nothing yet! Think we fight too many wars for oil? What will happen when countries (or worse, corporations) start hoarding water?

5 Comments

It has always struck me that the stock market is particularly arbitrary. A person would never invest his time and money in a business that doesn’t return something. But that’s what we do when we buy stock if that stock doesn’t return a dividend. It’s simply gambling. And I do it all the time. 🙁

Oil and water are at least good for something other than decoration. Gold, on the other hand, is pretty much continually at the top of a 10,000 year bubble.

To be fair redjohn, these days, there’s an actual use for gold in circuitry and shielding electronics. And I don’t care how far technology has come, I will gladly trade a tinfoil hat in for a gold one any day.

Sorry for the late comment, but buying a dividend-free stock is not gambling. If a company is profitable, then by definition, it will be worth more in the future than in the present. So if it is currently fairly valued – by wahtever metric you choose – then the company will be worth more in the future by that same metric.

Of course, others could disagree with your metric, so the actual stock could go up or down, even if your metric deemed it underpriced when you bought it.

I see gambling as something that is much more dependant on chance.

You’re simply gambling on whether the company will increase or decrease in value. If you have enough shares to have a vote that counts, that’s different. Otherwise, it’s only in name.

I’d disagree with your argument about chance being important. Knowledge can reduce or mitigate the risk, but not eliminate it.