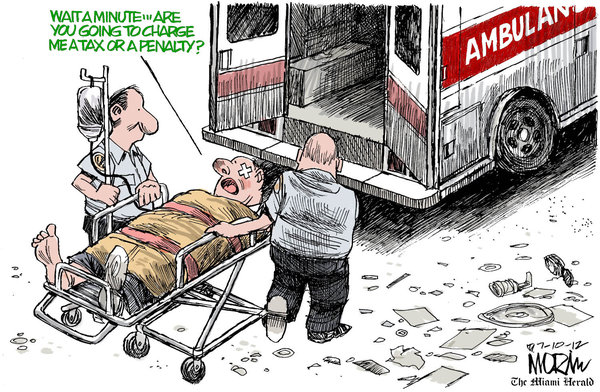

As I’ve said before, I don’t think it matters whether the consequence of not having health insurance is a tax or a penalty.

I’m not sure there is much difference between taxes and penalties. We even have taxes that are specifically designed to be penalties, like taxes on cigarettes and liquor. After all, if you want to discourage something, then a good way to do that is to make it cost more.

In fact, I would love it if we treated all taxes as penalties. Stop taxing things that we should be encouraging, and start taxing all those things that we want to discourage. I would get rid of income taxes and sales taxes — why would we want to discourage people from earning money or buying things? Instead, we should have strong taxes on carbon use (to discourage contributing to global warming) and on pollution. We should also have a stiff tax on political contributions from corporations. After all, the average corporation has a big advantage over the average citizen when it comes to having money to spend on politics, so we should level the playing field.

13 Comments

“I would get rid of income taxes and sales taxes.” It’s interesting that you included both. While it’s a nice idea, I’d be curious to see what your suggestions are to make up for the revenue gap. Are you suggesting that we essentially apply something like a VAT to intermediate steps, but with it being a “carbon-added tax?”

I agree with Michael. I know there are ways to get rid of Income and Sales taxes. I’m curious what you would do.

I trust that you’ll make it progressive: the poor should not pay a greater percentage of their income to merely survive, compared to the rich.

Some people pay income tax on inherited money. My mother said that she never earned a quarter in her life. She proudly paid her taxes. She won at bridge a lot and always paid taxes on her “gambling” income. I did tax returns for 28 years, 7000 taxes returns. Low earners. I heard very little complaint from clients wanting to share their income (I.E. pay taxes) I did hear from my neighbor quoting Fox News that it is the entitlement programs that ruin this country. I wasn’t fast enough on the uptake to ask if he was refusing the $1000 the Federal government handed him in the child tax credit.

“We should also have a stiff tax on political contributions from corporations” I think a tax on any political contribution greater then the maximum ($2500 per year for individuals)allowed is a good thing. That might fix what the supremes can’t. But I think it should apply to all entities including unions and other organizations. One limit since we are all viewed as people anyway. Heck tax it at 100% and see what that does.

I’d also be interested in your ideas for alternative taxing methods. The only negative I see for taxing things “someone else thinks is bad” is who the someone else deciding is. Meaning, if we took it to extremes we’d become a nanny state taxing foods that have a fat or sugar contents above a certain level. Toys that had no educational value, or pets that aren’t working animals, or non necessary modifications to vehicles like racing tires or exhaust systems. Stereos that are too loud, or even excessive use of protable electronics like cell phones contributing to battery waste. The list could be endless.

EBDOUG, what is child tax credit? Is the government giving us money from nothing? For me it is always been that it reduces the tax amount that I have to pay the government. How returning the money that I gave government is entitlement for me?

I’m laughing out loud here. I listed a couple of examples, but the main point was to shift the tax code so that it was based on taxing things we want to discourage. But people seem to be freaking out that I said I would eliminate income taxes.

How about if I put it this way — I’d like to see Congress pass some bills that tax things we want to discourage, and use that revenue to reduce taxes like personal income tax and sales tax.

Even funnier is Thought Dancer. Are you implying that our current personal income and sales taxes are progressive? Is that why Mitt Romney pays so little in income taxes that he is afraid to release his tax returns? And you don’t get more regressive than sales taxes. But to answer your question, I thought I had made it very clear in previous posts that I would make taxes progressive.

More examples? I’d tax inheritance as close to 100% as possible (with pragmatic exemptions of course). See the About page for this blog for my opinion about that. And I already mentioned luxury taxes.

And to Hassan, since all government money comes from us eventually, then the same argument could be made for any government spending. I hate the fact that the government gives out lots of money to rich people in the name of tax incentives, and people don’t consider it government spending. It’s a scam.

So, rather than me list off other examples of good taxes (that are progressive and tax things we want to discourage) can you guys give me some new examples? I’m sure you can think of some.

Re: taxes and penalties. Pretty good idea, but let’s not exclude the multi-billion industry called Religion. Churches, ministries, religious educational institutions all require government services and are often engaged in political activities.

Good point, Phillip. I’ve often wondered why businesses owned by religions (and have nothing to do with the actual running of a church) are tax exempt. Isn’t that a clear violation of the establishment clause of the Constitution to allow the government to pick which organizations qualify as religions and give them tax breaks?

Eliminating that would raise lots of revenue.

Well, we could go back to tariffs like the historical gov. revenue producer. The penalty would be on imports not on domestic manufacturing. Like WalMart would let that happen..heh. It was done originally by the great and wise forefathers who created the Constitution so properly spun there might even be buy-in from the tea-brainers.

IK@6, I wouldn’t say that I was freaking out over your suggestion. I’m just not convinced of the economics of it. Income tax is unique because the government and the worker have aligned incentives. If the worker makes more money, both benefit. Therefore, the government has the incentive to create an environment in which the worker CAN make more money. (To what extent that is currently happening is a matter of debate.)

However, taxing bad things creates opposing incentives. For instance, take sin taxes like those on tobacco. If n people smoke and the current revenue from taxes is c, you have nc dollars. However, if you double the taxes to 2c, you will not end up with 2nc dollars, because some of those n smokers will quit. So the government has to decide between (a) encouraging people to quit and dealing with reduced revenues or (b) encouraging people to keep smoking in order to keep revenues higher. The problem with (a) is that it leaves less money for good things the government can provide.

While I think taxing bad things is a good policy with the intention of changing behaviors, I do not see it as being a reliable source of revenue that can replace income taxes in the long run.

And Phillip and IK@8, couldn’t agree more. As Frank Zappa said, “Tax the churches.”

Don, the problem with tariffs is that they would backfire. One of the reasons that Chrysler has been able to be recover since the bailout is that they are in high demand…in China. If we increased our tariffs, the Chinese would simply do the same. And I don’t think we’d win that battle.

IK – I generally agree with you, although the primary prupose of taxes is not to discourage inappropriate behavior, or to penalize appropriate behavior, it is to pay for shared services. That system should have everyone pay into it that can afford to, and be progressive. On that basis I think income and property taxes are actually the best and fairest way to accomplish that and the easiest to implement and track.

Arthanyel, even under your definition (paying for shared services), taxing the use of shared resources and asking companies to pay for the clean-up of pollution and resulting health problems makes perfect sense. We should charge for externalities.

And something like a carbon tax is no more difficult to implement than any value-added style tax. Certainly easier to implement than income taxes.

So how about if I expand things a bit and say that taxes should either be penalties to discourage things, or charges to cover the cost of providing government services (a good example of the latter is gasoline taxes). I would also keep corporate and business taxes, because the government has to provide services to make those possible (also, businesses have to keep detailed records anyway, so calculating taxes doesn’t add much burden onto a business compared to taxes on individuals like income taxes and sales taxes).

IK – Completely agree. If anyone, especially a company, acts in a way that requires an increase in services to compensate (cleaning up pollution being a terrific example) then it makes perfect sense they should pay more for those services – they are driving the need for them.

A properly structured tax system would likely require less income tax and more “other” taxes like the carbon tax. That said, if we use taxes to discourage behavior (like the carbon tax) then hopefully that behavior – and the revenue from it – goes away. As long as the demand for the service goes away too, that works. Otherwise we still need to pay.

National defense, education, health care, Social Security, and a most other government services benefit everyone. The first two at least also benefit the wealthy more than the poor (the wealthy have more property to protect, and need more educated workers to make their money) so asking them to pay more seems quite reasonable. And asking everyone to contribute for them, to the extent they can contribute, is also reasonable.

I, for one, despite being “wealthy” feel it is ABSOLUTELY fair that I pay more than someone less fortunate. And I have a strong belief that asking people struggling to feed, house and cloth themselves to contribute much, if anything, is both morally reprehensible and counter-productive. Either reason would be enough on its own. If we can find a fair and progressive way to pay for those services without taxing income directly I would be all for it, I just think its not unreasonable and as its already implemented, easier to manage 🙂