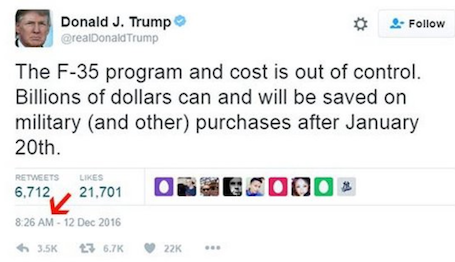

On December 12, at 8:26am, apparently out of the blue, Donald Trump made the following tweet:

The stock of Lockheed-Martin immediately dropped 4%, losing $4 billion in a few minutes.

Trump has attacked companies before. Just a week earlier, Trump attacked Boeing, causing its stock to drop 1%. Trump’s tweet that time happened an hour after a newspaper published a column by Boeing’s CEO criticizing Trump’s anti-China rhetoric.

But there was no obvious trigger for Trump’s tweet this time. Even more suspiciously, six minutes before Trump’s tweet hit the innertubes, someone started dumping large amounts of Lockheed-Martin stock, which would indicate they knew the tweet was coming.

We don’t know who was dumping stock before the tweet. Because we know almost nothing about Trump’s finances, it could have been Trump himself. Or a family member, or a friend. Chris Christie or Rudy Giuliani. Or Putin. Or someone blackmailing Trump.

Insider trading is illegal. Even worse, the president benefiting from something done by a foreign government is unconstitutional, and is grounds for impeachment.

Now that the Benghazi committee has nothing to do, maybe they should investigate this. Over and over (and over) again.

6 Comments

Someone knows who the person is who dumped the stock. The information goes right to the IRS.

Regarding the stock dumping, my advice would be not to jump to conclusions (yet). Does it look suspicious? Yes. Does it warrant investigation? Yes. But.

We first need to confirm that the timestamps are, in fact, accurate. The timestamp on the tweet and the one on the graph are from different computers that may be out of synch. We also need to confirm that tweets are timestamped based on when they are first received by a central server vs. if they are timestamped based on reception by a distributed replica. 6 minutes isn’t much of a difference (could actually be closer to 5 minutes from 8:20:59 to 8:26:00), and there are plenty of algorithmic traders that automatically trigger trades based on keywords. So, we need more information to check the timing first.

Second, we don’t know what Drumpf saw to trigger the tweet. It’s plausible that both his tweet and the sell-off were reactions to a third event that we haven’t seen yet.

Sketchy and needing investigation? Absolutely. But we need to investigate before calling it insider trading. Isn’t total lack of transparency fun? It’s going to be quite the wild ride for a few years…

Sure, timing is everything when it comes to the stock market. The Boing episode may be much ado about nothing after all, but the IRS (SEC?) would (or at least, should) be expected to be the final judge of that.

But worse, these are the kinds of conflict of interest issues that will continually dog the Trump organization until (if ever) he fully divests his business interests into a blind trust, like every president before has. Every decision he makes, every mindless boast, threat or tweet, will be viewed through that microscope by friend and foe alike. The kids in charge don’t count as a blind trust by any stretch, of course, and with Ivanka & hubby apparently planning to work from the east side of the West Wing, he has shown no serious indication he intends to do anything but the exact opposite. The WH appears to be in the planning phase of renovations on its way to becoming Trump Headquarters International.

Gropenfuherer boasted in the past that if he ever ran for president, he would be the first one in history to make money off it. So far, looks like he’s planning to make good on at least that one promise.

Oops, I meant “Trump administration”. Freudian slip, I guess!

Hey, maybe this will get his attention…naaaah!

http://thehill.com/blogs/floor-action/senate/310537-senate-dems-rolling-out-bill-to-force-trump-to-shed-conflicts-of

So, I checked the timestamps on a Bloomberg terminal that gives a fairly detailed analysis of the trades and prices just before and just after the tweet.

Note that the tweet arrived just before the market opened when the market is “thin” and there are relatively few trades and quotes. From what I see, there is no evidence that the price dropped before the tweet. I suspect, but cannot prove, that the original source of this story had stale or “bad” prices before the market opened.