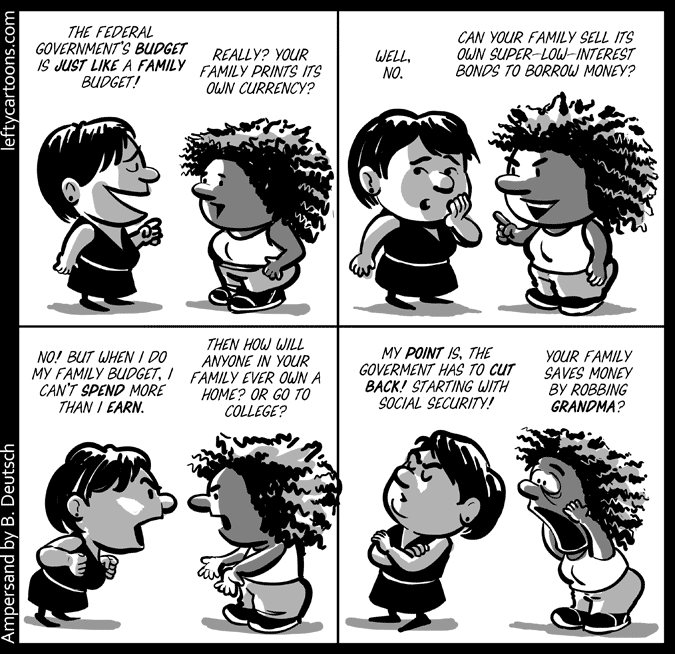

I’ve often commented about the idiocy of comparing the federal budget to a typical family budget. But I had to post this comic because of the last panel. Indeed, some politicians are proposing exactly that — to steal our elders’ Social Security insurance money.

Who would ever suggest such a thing?

3 Comments

And food stamps. I can’t see as a resident of this country why great wealth in the hands of the few supersedes making sure our residents are fed, have clothing and shelter. And that the farmers can stay in business. They tried this at the end of the 1920s. Didn’t work then, won’t work now. The gap between the rich and the poor steadily increases. That’s what we want for our country while television tells the poor all the things they are missing?

Re: Borrowing. I borrowed for my first house, then moved to forty acres along with my two small sons. I borrowed $7500 to pay for land and three barns, one with electricity. This was forty years ago in 1973. We had plumbing two years later. I learned to build and converted one of the barns to a house, paying for the electricity and plumbing to be done. One step at a time when I earned the money.

College was $150 a semester without living on campus. We also went summers to get my BSN,RN.

I borrowed for one car, then drove clunkers until I could start paying cash for cars.

In other words, it can be done. Land is still cheap in places. College can be done one course at time on-line while working. Grants are given for those low income people. Life can be lived without paying interest if you are willing to wait for gratification.

I came here to comment on the “family budget” analogy so beloved of the extremists. My least favorite part of it is that they don’t even practice what they preach.

I mean, if a family starts running in the red, how often do they decide that they need to lower their income? Yet the fringe element has a magical belief that reducing revenue will make everything better — or so they say.

But I also feel the need to respond to EBDoug’s post. Life can be lived without paying interest, yes, but not by everyone.

For someone who doesn’t have the skills to make a go of rural life, the path you followed is not an option. And all the other paths involve cash, and a vision — which, if you live in a city and work for minimum wage, are both hard to manage, live you never so simply and idealistically.

Also, 2013 is not 1974. I am also a geezer, and also debt-free. But even if you’re not seeking credit, the negative impact of being outside the debt game has some nasty consequences — when we were young, you didn’t need a good credit score to get a job, for example, or to get a utility hookup. You didn’t need a credit score for anything, really — but that was then.