Taxes are at historic lows since WWII. And we did pretty well while taxes were high. Why is letting them go back up to where they were during the Clinton administration such a issue?

Yes, our population is aging, and this will be a problem for Social Security and Medicare, but the solution isn’t to cut taxes even more, which is what the Republicans are proposing.

7 Comments

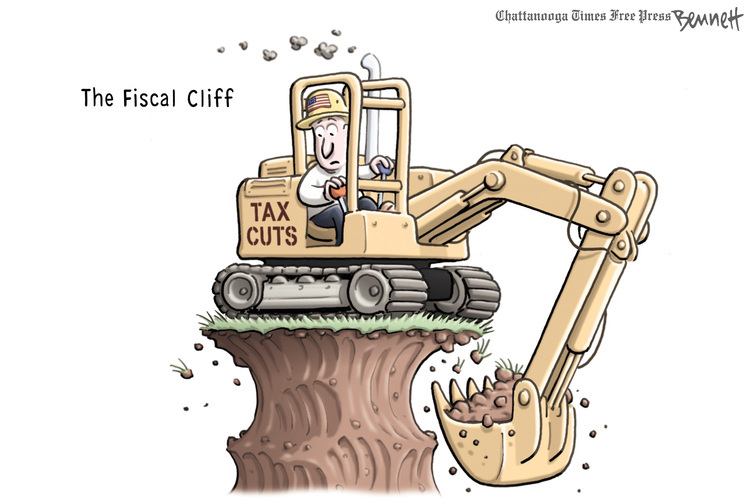

Some basic facts to cut through all the propaganda on the topic of the fiscal cliff and balanced financial management:

The US GDP for 2011 and 2012 is about $15.5T. It is currently growing very slowly, less than 2% per year.

Total government spending is about $3.7T, or about 24% of GDP

Total government revenues are about $2.4T, or about 15.5% of GDP

HISTORICAL AVERAGE revenues over the last 60 years have been 20% of GDP.

Therefore, to balance the budget in comprehensive way should look like raising revenue back to about 20% of GDP, and cutting spending to about 20% of GDP. Which would look like:

Raising taxes by $700B per year

Cutting spending by $600B per year

Neither side is proposing anything CLOSE to this, however. ALREADY AGREED UPON spending cut levels are about $200B per year. Obama is proposing to increase this by $60B (to $260B) and raising revenues $140B, not quite a 2 to 1 cuts to taxes proposal,. Republicans are proposing ADDITIONAL cuts of $140B and revenues of only $80B – $340B in cuts to $80 in revenues, or 4.25 to 1 cuts to taxes proposal.

But look above again – the problem is more than 50% REVENUE related. Therefore it should be obvious that Obama is already going TOO FAR with cuts vs. tax increases, especially as he is offering to make all tax cuts on the bottom 98% “permanent”. And he is willing to go EVEN FARTHER with cuts if Republicans would agree to a comprehensive deal including appropriate tax increases on the wealthy.

And in reality, if we dealt with our debt crisis like a real crisis (which it is) we should temporarily raise taxes AS HIGH AS POSSIBLE until we pay down enough of the debt. Something like an additional 5% of GDP surcharge on those that can afford to pay, and then as the debt begins declining all interest payments “savings” are automatically applied to debt reduction as well (a debt snowball) and we start dropping the surcharge as the debt decreases. When it is low enough that it is stable (surpluses in good years, small deficits in bad ones) the tax surcharges can be dropped completely.

Bottom line – Obama is much closer to spot on, and Republicans are crazy. You can’t solve the problem with just cuts, and you can’t keep the economy growing and address core services like education and the programs that tens of millions rely on every day just to eat if you try to cut your way to a balance.

Great summary. Thanks!

Wow, that’s missing so much information.

You mean “income taxes” are at historic lows…let’s throw in Medicare Taxes, State Income Taxes, Corporate Taxes and the host of other taxes that didn’t exist during WWII or shortly afterwards. The tax burden is higher than it was back then. Thanks to the new ObamaKare taxes and other taxes we’re already paying more than we did under the Clinton years, but again not in income taxes.

Also if you look solely at taxes you are missing 2/3 of the economic equation. Do you want to bring spending and social programs back to the same levels they were post WWII…how many programs weren’t around?

What about the economic conditions? Post WWII the United States was the manufacturing powerhouse of the world…now, not so much because of cheaper overseas labor. Those jobs aren’t coming back. No tax increase will do that.

And regulations? Do you want to rescind NAFTA and other trade deals? Get rid of the OSHA and EPA regulations from the past 12 years and return to Clinton level regulations? Maybe go back to WWII levels?

Why only look at taxes, when the economy is so complex? Sure it’s nice to say “Tax the Rich” if you’re not rich and want someone else to pay. But why not look at the entire equation? Probably because that hurts the argument.

We have a spending problem.

Your economic assumptions are still importing the “conservative” economic ideology, which are entirely hazardous to any progressive priorities. If progressives generally would adopt a more functional sort of economics, there would less likelihood these embarrassing surrender to more fascist plundering and higher levels of inquality. If we have a “spending problem” is for lack of understanding that we are spending too much in the wrong places and not near enough in the places where the public good will be served. Nearly every time that the austerity jack booted criminals show up progressives surrender to nonsense economics. Try considering an economic model that is actually scientific rather than primarily ideological. Do a search for Modern Monetary Theory, or Stephanie Kelton, or William K. Black, or L Randall Wray. Kelton is very good at speaking to general audiences. Or try this interview http://www.youtube.com/watch?feature=player_embedded&v=Yiw8Lyw1XGc That nominal progressives continue to adopt the free market economic ideology is the darkest irony of all

“Didn’t exist during WWII or shortly afterwards.” The Corporate Income Tax began in 1909. Nice thing about the internet is that, there is no need to have opinions about factual information when the facts are available. Including the fact that, the top corporate tax rate is already LOWER now than it has been at any time since 1942.

And lt’s not forget about those loopholes, shall we?

Getting back to real basics on economics, read, “The Wealth of Nations,” by the original Adam Smith. 18th century English makes it a tedious read, but Smith misses nothing. Which is why the book is still required reading.

Dave Fortay: You are wildly in error.

First, I stated tax REVENUES, not tax RATES. And I was talking total dollars, not breaking out Social Security, Medicare, etc. So my statement is still accurate – historically (over the last 70 years) tax revenues as a percentage of GDP have averaged about 20% of GDP. FACT.

Second, your statement that “we are paying higher taxes already than under Clinton due to Obamacare and other new taxes” is a PANTS ON FIRE lie. Tax burdens on everyone are LOWER than they were under Bush and nowhere CLOSE to where they were under Clinton at ANY level.

Third, I am not looking solely at taxes. I am looking at a balanced budget. If tax revenues are historically around 20% of GDP, then to balance the budget spending must also be around 20% of GDP. That’s a mathematical necessity.

Fourth, the argument that we are strangling business due to recent over regulation is conservative propaganda, 100% fact free. Some regulation (EPA, for example) is critically important. And Obama has implemented fewer NEW regulations than Bush.

Finally, you bottom line “we have a spending problem” is misleading. We do have a spending problem – we are spending 24% of GDP. A significant portion of that excess spending is in the DEFENSE BUDGET which Republicans refuse to touch. And the revenue problem is LARGER than the spending problem. We have both kinds.

Go peddle your Faux News propaganda elsewhere and get the facts.

Arthanyel – you’re right we really do need to raise taxes, its inevitable along with serious spending reductions. The balanced approach is the only solution. We can’t tax our way out nor can we cut our way out.

As to Dave Fortay’s take on taxes, he’s made some good points. There are many “non income” taxes, fees, etc that come into play and we need to consider the whole package. My state routinely comes up with creative ways to increase revenue by feeing us along with slippery new taxes on anything but income, which in the end reduces buying power. In the last 4 years they’ve raised sales tax by 1% (20%increase), addes sewer fees, gas tax, alcohol tax, and nemerous other revenue enhancers. They always come back and say they need more money. Here’s the creative way they justify it by saying they’ve cut all they can out of the budget. First the prepare a budget that increases spending by 10%, then they cut (increases to spending) and pass a 2% increase saying they cut the budget by 8%.

I have several modest investment properties that I rent out. Lets take for example 1 that I bought 10 years ago. Purchased for 170k it will hopefully be sold after 20 years for 340k. Wow the novice would say thats a nifty profit. But lets look deeper. Based on owning it for 20 years I should owe about 30k by then, which the novice says wow another 140k in profit. Actually thats a recoup of initial investment. On that sale I will owe the depreciated value the gov mandates I take on a 27 yr straight line which would be about 140k and I’ll be taxed at regular income rates at the proposed 39% rate or 54,600. Then for the difference between 170k and 340k I’ll be taxed at the capital gains rate currently 15% and proposed by some at 50%. So lets assume the middle at 32%, thats another 54k in taxes. Now lets remember the fact that I’ve been paying property tax (currently 3600/yr) for 20 years, thats 72k. Now over 20 years I would have paid 72k and at closing another 108k and that does not include all the taxes at closing and fees for having an investment property and rental property licensing fees, etc etc. So after putting my money at risk for 20 years I can expect to reap the huge profit of 340,000 minus my investment of 170k minus my income/capital gains taxes of 108k minus closing costs of 20k getting in and out, realtor fees of 17k = 25k or 1250 per year. Wow.

Now I realize my renters paid most of the 140k of the mortgage and I still would owe 30k. Sounds great though doesn’t it. Oh I also had to put in a new kitchen, new heat and AC, all new plumbing, new bathroom and new electric.

So total over 20 years i would have paid 180k in taxes (prop and income) on a 170k investment. Of course thats separate from my regular job and the taxes I pay for that.

My original plan was to use the investment properties to pay for my kids college, but it won’t come close after taxes, so they’ll just have to go to the gov’t to get my tax money back to pay for college. I could save them and other taxpayers a whole lot of overhead costs if they just let me do it myself, really.