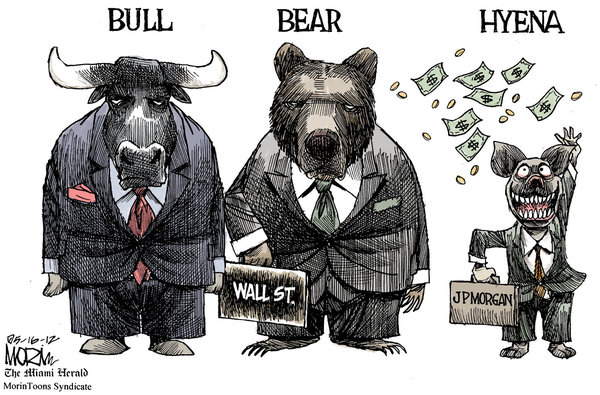

Even after the great recession, JP Morgan CEO Jamie Dimon was considered the best and brightest of the bankers. He argued that new regulations were not needed and that his company shouldn’t be penalized because other bankers were stupid. So now that his company did something really stupid, will he change his tune?

As other people have pointed out, the problem is that there is too much incentive for bankers to take stupid (albeit potentially rewarding) risks. The rewards are just too great, and the risks to the person doing something stupid are minimal, since at worst they will just get fired and they can then go get a job at a hedge fund making even more money. The risk to their company is also less than it should be, since the government is all too willing to bail them out if they get into real trouble. Indeed, the message to the bankers is that if you are going to take a risk, make it a really big risk!

One Comment

The underlying assumption tends to be that Dimon and the Wall Street goblins are stupid or incompetent. It stands to reason actually that they are very competent toward achieving their personal and class interests. The perversion of CEO pay being on a commission/profit sharing basis actually encourages fraud at the top, the technical term in criminology is Control Fraud, and it is committed by encouraging and rewarding apparent earnings over a short time period.

One Trackback/Pingback

[…] Financial Animals. Like this:LikeBe the first to like this post. […]