© Jim Morin

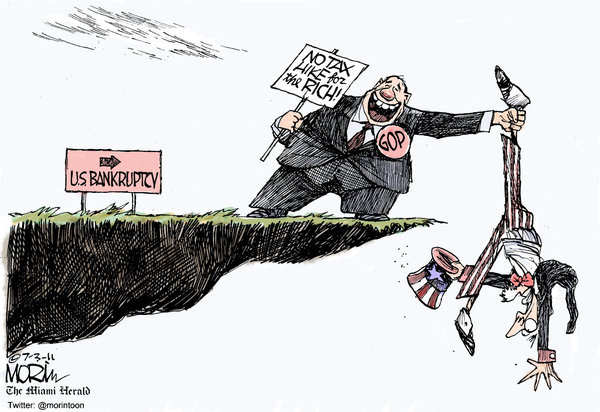

The Republicans say that raising taxes is not allowed. Nancy Pelosi has declared that Democrats will not support cuts to Medicare or Social Security benefits. So who is going to blink first?

Warren Buffett has one solution: “I could end the deficit in 5 minutes. You just pass a law that says that anytime there is a deficit of more than 3% of GDP all sitting members of congress are ineligible for reelection.”

15 Comments

Obama said SS and Medicare are on the table

The long term balancing of the budget and starting to pay down the debt has been examined in exhaustive detail, and all non-extremists agree that a real solution has the following four necessary conditions:

1. Increased revenues compared to now (by at least $250B per year).

2. Restructuring Social Security to account for longer life spans and people that have sufficiently provided for their own retirement.

3. Cap medical cost growth at the rate of inflation and restructure Medicare/Medicaid to decrease the costs of benefit delivery.

4. Reduce Defense spending by ending the current two wars and reducing or eliminating expenses that are no longer effective (do we really need 50,000 soldiers in Germany?).

Virtually all would also add a 5th, reduce waste and eliminate marginal discretionary programs, but that is a lot more controversial in the details.

To achieve a structurally balanced budget, we have to do all 4 (or 5) or we just can’t get there from here without potentially catastrophic changes. Examples of catastrophic changes would be total privatization of Social Security or Medicare, implementation of a single-payer medical system, massive tax increases (marginal tax rates up to 85+% of income, just like they were from 1942 to 1962) or downsizing the military to pure US defense only. Such changes would have major cuts in spending, but the economy itself, and the private companies and employees that participate in these areas, would be massively disrupted and might cause a crash that would shrink the GDP and offset the value of the reduced spending.

So while we need intelligent factual debate about priorities and while there is real room for disagreement on how to mix the pieces together, anyone, conservative or liberal, Republican or Democrat, that claims we can fix our long term budget issues without doing some of ALL of these is simply mistaken.

Arthanyel – I agree in spirit with your 4 suggestions. The fifth is irrelevant to me since discretionary spending is really a tiny portion of the budget.

I am curious why you think Social Security would have to be privatized to restructure it in the way you suggested. There have been plenty of proposals that do what your first suggestion states without privatizing it.

I would also point out that Medicare is already a single payer program. It just has no meaningful cost controls in place.

I don’t know enough about the marginal tax rates to comment on the 85%+ suggestion, but I am skeptical about it. There seems to be quite a bit that needs to be done on corporate tax loopholes and subsidies that would likely bring those top marginal rates to something less than 85%. How much less is beyond me but I’m sure others here can comment.

I’m also generally skeptical of any claims that change will result in catastrophe. Would all of this result in important restructuring of the economy? No doubt. Would it be catastrophic? I don’t think that is very likely.

*your second suggestion states. Sorry about that.

People living longer does not mean they can work longer. As an over-50 engineer, I’m already facing difficulties.

Buffet’s idea is brilliant!

Anonymous has a good point. Even though total life expectancy is going up, the life expectancy of 65 year olds is about the same as it was when Social Security was created.

Starluna – perhaps my writing was not clear. I don’t think Social Security should be privatized at all. I don’t see where I suggested such a thing. The consensus opinion I reference is that there needs to be some form of means testing (to stop sending checks to people that do not need them) and improved incentives for people working to enhance their own retirement (like the 401K and IRA vehicles). Not to replace Social Security, but to augment it so that as more people are retired and living longer while less people are working the program can remain cash positive.

To anonymous’ comment: living longer does not mean working longer. Absolutely true. But living longer DOES means drawing more Social Security benefits. So as the population ages, the number of retired people increases and the time they draw benefits increases, while the workforce contributing to Social Security decreases. At some point it inevitably goes cash-negative. Had the trust fund not been looted by Congress, that date would have been off far further into the future, but unless we have another baby boom and start growing middle class incomes Social Security, untouched, will be a problem in the future.

The comments about catastrophic changes are not suggestions or things I would recommend or support – far from it, with the possible exception of eventually moving to a single payer health system. They are examples of the type of change that would be needed to balance the long term budget without addressing all the areas intelligently, and they are “catastrophic” from the standpoint that they would massively disrupt the economy and potentially cause more problems than they would solve. You highlight a few (again, I am not recommending them) but here are some more details:

Medical costs. Over the long term, the costs must be held to the rate of inflation or below, or medical costs will eventually overwhelm the entire budget. One approach to holding costs in line would be implementing a single payer system for all medical coverage. The problem is that so much of the economy is connected to the current health care system, moving to a pure single payer system will have a dramatic impact and hundreds of companies and hundreds of thousands of jobs would be impacted. Is it a good idea? Perhaps, but it is also very risky, and the transition would have to be long and carefully managed.

Tax rates. The marginal tax rate on the wealthiest taxpayers from 1942 to 1962 was about 90%. Increasing the tax rate today back to that level would generate on the order of $1.4 trillion dollars in new revenue per year. That just about balances the budget, but the impact of that dramatic a tax increase would likely cause a massive disruption, and certainly with today’s trade agreements and international access would drive a lot of money (and people) out of the country, reducing the benefit.

Would such changes be a real catastrophe? Maybe not, but any changes that significant will have large repercussions and are very hard to unwind, so the intelligent thing is not to take those risks until they are required – and we can balance the budget without taking those risks.

The bottom line: Liberals claim the budget can be balanced in the long term only with tax increases and defense cuts, not touching Social Security or Medicare in any way. They are wrong. Conservatives claim the budget can be balanced only with cuts to social programs. They are also wrong (more wrong, actually, since the budget can’t even be balanced in the short term with cuts alone, but wrong is wrong). The reality is we have to make appropriate adjustments in each area, and the debate should be about what are ‘appropriate” adjustments.

I can’t find the study right now, but I’ve read at least one very detailed demographic analysis that found that among non-white groups and those with lower incomes, the average age at death has risen to about what it was for the wealthiest in the 1940s. This is in part thanks to rising material conditions and Medicare. The folks who are living significantly longer are the wealthiest. It’s rather sad that the average African American man is only able to receive Social Security for a few years, and a significant proportion never live long enough to benefit from it at all.

I do not believe that the characterization that liberals believe that the only way to balance the budget is to increase revenue and that conservatives believe that the only way is to cut spending. Every study and most conversations I’ve had on this subject finds that people have very complicated views on the matter. The media seems to focus on the few who spout these extreme positions, but I don’t think it is really that simple. At least it wasn’t until this brinksmanship approach to getting the budget done became Congress’s MO.

The concerns about massive disruptions I think are overblown. They remind me of the debates around Medicare. The debates in the 1960s over Medicare involved all kinds of predictions and concern about massive disruption of the medical care system, with a healthy dose of hand-wringing about socialism. The AMA was dead set against it, as were most hospital systems. One common claim was that no one would want to become a doctor anymore. Of course we know now that the health care system, physicians in particular, benefited greatly from it.

The same story is told with CAFE standards, the Clean Air Acts, the ending of slavery, regulating cigarettes, etc. Just about every prediction of catastrophe over changes that impact the economic and social life in the US have not even remotely come to pass. The one notable exception being Eisenhower’s cautions about the military industrial complex.

Regarding the consequences of increasing marginal tax rates on the highest incomes, again I am skeptical of Arthanyel’s predictions. Will the wealthiest decide to move elsewhere? I doubt it. The only other countries that have a similar quality of life as the US have much higher tax rates than the US. And research has found very little support for this idea. I believe a recent survey on this was posted on this blog not too long ago. Moreover, up until recently, the US was the safest place to invest, among places where there is any certainty about investments. And according to many economists, we still are a very attractive place to invest. Indeed, the one thing that is causing reticence among investors is the sorry state of regulation we have here and this budget nonsense.

I admit, though, that I don’t know of any international trade agreement that dictates what the income and corporate tax rates of an individual country should be and would be curious to which ones those might be.

I couldn’t find the original study that I was thinking of but I did find this very recent analysis by the Institute for Health Metrics and Evaluation that finds that life expectancy is actually declining in the US.

http://www.healthmetricsandevaluation.org/news-events/news-release/life-expectancy-in-us-counties-2011

Mind you, what really matters for the long term viability of Social Security is not life expectancy but average age at death (which is calculated differently). However both trend in the same direction, so it is still valid to look at life expectancy when thinking about what might need to change to ensure the health of the Social Security program.

What is important is the life expectancy for people over the age of 65, since that around when most people start Medicare and Social Security. Or alternatively, the average number of years people utilize Medicare and Social Security. Total life expectancy is skewed by infant mortality, which doesn’t affect old age benefits (and they are too young to pay into it either).

IK – that is right. There are different methods of calculating life expectancy, even if you use 65 years as the starting point. I’m not sure what measure the SSA actually uses when they do their calculations though. I wouldn’t be surprised if they are using the simpler, and less accurate, measure.

Starluna – I respect your consistent and thorough research, and all of your thoughtful comments. I may not be clear in my own points, so I apologize for any lack of clarity, as we are in agreement about most of these issues. But I do want to be clear, so I will try again to make sure I am being clear.

On Social Security, the long term challenge is the population of working adults contributing to the fund is shrinking, the number of retired adults is growing, and advances in medical science are lengthening life expectancy (at least in theory). Over a long enough time this combination will inevitably drive the program into a negative cash position. We can discuss which pieces have the greatest impact, but I can find no non-partisan study that suggest Social Security can remain solvent with no changes at all.

“Fixing” Social Security will require changes – every non-partisan projection shows the negative cash problem, the only debate is about when the crossover happens. The fixes do not, however, have to be benefit cuts – and I don’t believe that cutting benefits is the answer. Examples of non-benefit fixes include taking the cap off maximum income for SS contribution (currently capped at $106,800) and means testing so that those who already have sufficient retirement income (especially the wealthiest 5%) do not also receive benefits.

I understand your response on the characterizations of liberals and conservatives and what they will support. I can only point to the current debt ceiling discussions as evidence that at least among Washington politicians, the liberals state consistently that Social Security and Medicare “are off the table and cannot be touched” and conservatives consistently state “tax increases and defense are off the table and cannot be touched.”

Concerns about the disruptive aspects of the larger changes may be over – or under – stated. My only point here is that there are bigger risks involved in making major changes, and so they should be avoided if lesser changes will solve the same problem. Occam’s Razor.

Regarding marginal tax rates and impacts – perhaps I was too quick to suggest rich people will leave the country. It is more likely that only a portion of their income would leave the country, but the impact is the same. Also, please note that while tax rates are higher in many countries than in the US today, there is no first world country with a top tax rate over 60%, so if the US was to raise the rate to 85% I think it is very likely rich individuals would move as much of their income as possible to other jurisdictions, resulting in a lower total US revenue rate.

Hopefully that makes it clearer.

I completely agree that changes need to be made to the Social Security program to ensure its long term viability. In addition to getting rid of the wage cap, I’d also support taxing certain non-wage sources of income. I support means testing in principal, but political-sociological research has shown that support of the program in the US would likely decline if it were not available to all contributors. So, if means testing were done, it would have to be carefully structured so that the program remains political feasible, which unfortunately means not antagonizing the wealthy too much.

You might be right that most other developed countries do not have a top marginal tax rates that exceed about 60% (I’m too rushed right now to look this up). But those other countries also tax more income and more products than we do. Individuals who live in most other developed nations pay a greater proportion of their overall income in taxes than we do here.

I personally think we have bigger problems with Medicare than with Social Security. If we do not take control of medical care costs, Medicare will implode in a much more fantastic manner than Social Security will and much, much sooner.

Completely agree on Medicare. The key issue there is health costs rise faster than inflation. I don’t see how private insurers can fix that without government regulation, and medical insurance isn’t really a competitive market and all the incentives in a for profit business work counter to the needs for medical care.

http://en.wikipedia.org/wiki/Tax_rates_around_the_world