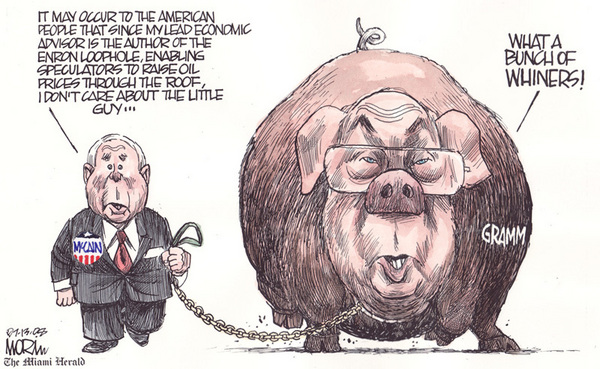

Who is Phil Gramm? You might have heard his recent statement that America is a “nation of whiners” about the economy. He is a co-chair of McCain’s presidential campaign and arguably his main economic advisor — McCain once called Gramm his “financial guru”. So let’s look at Gramm’s economics:

- Gramm was responsible for the “Commodity Futures Modernization Act” in 2000, which unleashed risky new investment instruments (which Warren Buffett called “financial weapons of mass destruction”) that led to the Bear Stearns bailout and the current epidemic of mortgage foreclosures.

- Enron CEO Ken Lay was chair of Phil Gramm’s 1992 re-election campaign to the US Senate. Gramm’s wife was a director of Enron from 1993 to 2001.

- Gramm co-authored Reagan’s first budget, which drastically cut Social Security benefits.

According to former official of the Commodity Futures Trading Commission and current law professor Michael Greenberger “Gramm has been a central player in two major economic crises — the credit crisis and the incredibly high price of energy.”

So when Gramm tells you to stop whining, it is because you are getting in his way of becoming McCain’s Secretary of the Treasury and costing you even more money.

http://www.alternet.org/election08/87999/?ses=0618493a853c88bc0e896bed4d8f6d7d

http://www.huffingtonpost.com/arianna-huffington/sunday-roundup_b_112337.html

UPDATE:

© Jim Morin

2 Comments

Let’s not forget that Phil Gram had his dirty hands all over the bad legislation that lead to the Savings & Loans crisis, and that he was also responsible for the “Enron Loophole” while his wife was working for Enron, which directly lead to Enron’s manipulation of the electricity market in California, rolling blackouts and exorbitant prices for energy there.

Also, Gramm tried to blame “environmental extremists” for the blackouts in California, even after it had been proven that Enron paid the power plants to turn out the lights.

More on Gramm here:

http://www.independent.co.uk/opinion/commentators/johann-hari/johann-hari-we-have-everything-to-fear-from-mccain-869681.html

8 Trackbacks/Pingbacks

[…] it was Phil Gramm, who before joining the McCain campaign as its “financial guru” was a lobbyist for UBS. […]

[…] the way, need we point out that Phil Gramm (McCain’s chief financial advisor until last week) was largely responsible for making those […]

[…] starters, that “transparency” could include admitting that McCain’s own chief financial advisor, former Senator Phil Gramm, was the person who was personally “accountable” for […]

[…] starters, that “transparency” could include admitting that McCain’s own chief financial advisor, former Senator Phil Gramm, was the person who was personally “accountable” for sneaking in the […]

[…] starters, that “transparency” could include admitting that McCain’s own chief financial advisor, former Senator Phil Gramm, was the person who was personally “accountable” for sneaking in the […]

[…] starters, that “transparency” could include admitting that McCain’s own chief financial advisor, former Senator Phil Gramm, was the person who was personally “accountable” for […]

[…] crisis possible. It should be no surprise that the primary author of this bill was none other than Phil Gramm, McCain’s primary economic advisor and his probable choice for Secretary of the Treasury. […]

[…] Everything Phil Gramm touches costs you money. […]