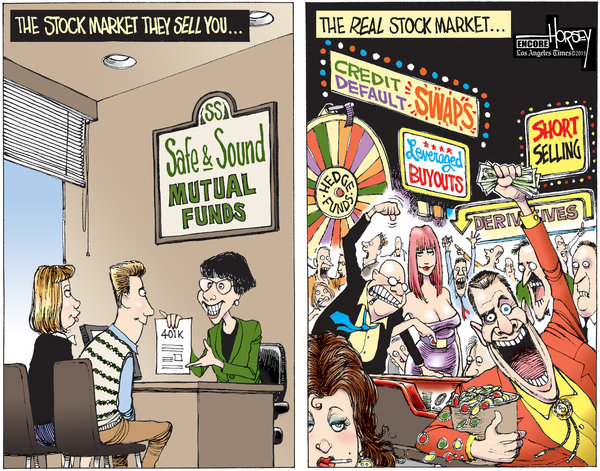

[Notes about the comic by David Horsey]

When are America’s leaders going to step up and protect us from the most threatening terrorists, hedge fund managers?

Sure, some Islamist nutcase might be able to set off a bomb on a bus or in a building, but, horrific as that may be, the damage to our society is not nearly as great as the wrecking ball that can hit us all when one of the greedy schemes of aggressive and unscrupulous financiers goes awry. Yes, Islamic terrorists took down the World Trade Center in 2001, but the financial terrorists took down the world economy in 2008.

Vast new wealth is being manufactured from thin air by the financial sector, and almost all of that wealth goes to the very few hedge fund managers, derivatives traders and other money manipulators who operate in a world of their own creation with scant regulation and no sense of obligation to society. The rest of us only get hooked into this bigger game when the guys in high finance screw up, drive the economy over a cliff and drag everyone down with them.

Right now, we are in a period of recovery from the 2008 financial disaster. Finally, there are more jobs for more people. But, structurally, nothing much has changed. We still live at the mercy of the financiers, and it is hard to imagine that they will not blow everything up again, unless someone steps in to stop their kind of terrorism.

It is a good sign that a crew of hedge fund managers from SAC Capital Advisors has been indicted for insider trading. Finally, someone has taken a shot across the bow of their pirate ship. But it will take far more to scare off this gang of buccaneers. There is just too much money to be made.

As Ted Siedle wrote in a recent column for Forbes, “There have always been scammers in the money management industry but hedge funds, with outrageous fees and compensation structures, are money management on steroids. The abuses related to the staid world of traditional investing, a percent or two here and there, are chump-change compared to brazen hedge fund gouging.

“While mutual fund managers sip tea, hedgies pound flaming tequila shots.”

6 Comments

I have a class mate who made his fortune in hedge funds and wrote a “how to” book about them.

He struts around because he made a fortune. That’s life to him.

For all the years I did taxes, I told clients over and over not to invest in 401Ks when they were at minimum wage and for the ones above that to make their own investments with an on-line company. Sad to realize that if they can’t/won’t do their own taxes, they can’t/won’t do their own investing. This is the 76% of the United States who didn’t read a book last year.

Pretty much what Anonymous said. The best thing about capitalism is that it corrects itself if you have a knowledgeable citizen base. Hedge Fund Managers schemes could be crushed if people simply stopped using them.

It is sad to say but people will spend lots of time on picking a vacation destination, but only give 5 minutes to their retirement investments. It really isn’t as hard as it seems. You don’t need to be very in depth. Buy some strong DOW companies and sit back, or put your money into an index fund!

Also while I agree with Anonymous with the invest your own money attitude, it would almost be silly to pass up a 401k. Your company matches you x percent, that is free money and shouldn’t be passed up. Just gotta do a lot of homework.

Or of course someone in gov could just fix the problem, but lets be honest, that isnt going to happen

I’m guessing Anonymous is really EBDoug.

I was thinking that myself. Ebdoug are you out there?

ugh…amusing comic, but here’s some perspective for ya:

http://online.wsj.com/article/SB10001424052748703302604575294983666012928.html

[cool jt morrow comic in there as well]

Yes, sorry, I posted before I realized my name had been wiped out. I also agree that if a 401K is matched, it should be invested in up to the company matching. I’ve seen minimum wage people invest in 401K, take it out right away (say the next year) with the 10% penalty. It is very sad. Obviously on minimum wage, there is no tax advantage as they pay no federal tax, but when it comes out it is taxable even though it wasn’t taxable because of the bracket going in.

I had a husband/wife team with one W-2 come to me. When he retired, he got something he felt was over my head and went to a “Financial Consultant” who talked them into an annuity so the Financial Consultant could get rich. They wanted me opinion which I gave. They went with all her false promises anyway. Sad.