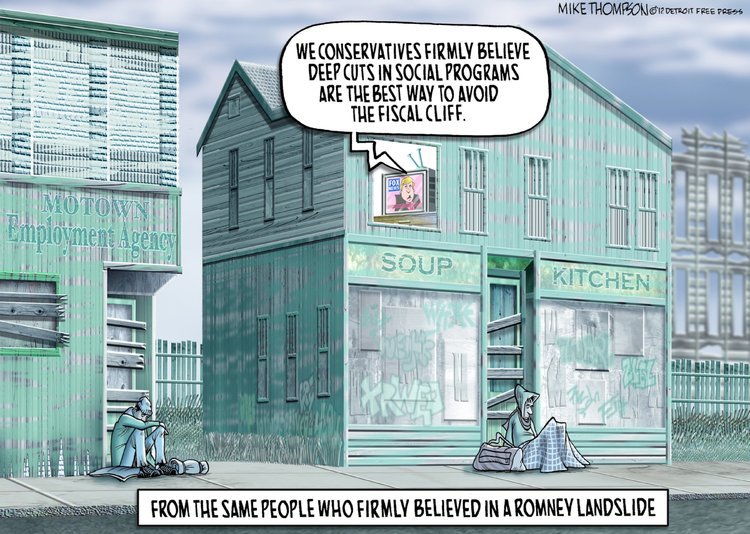

Even Republicans who are pretending to want to compromise are saying they will only do it only if the Democrats agree to “entitlement reform“, which is their code phrase for cutting Medicare and Social Security. This is their plan for gaining popularity? Or just a ploy so they won’t be blamed when we go over the fiscal cliff?

-

‹ Home

Info

-

Subscribe

-

Users

Links

- All Hat No Cattle

- Andy Borowitz

- Axios

- Barry Deutsch

- Bearman Cartoons

- Beau of the Fifth Column

- Capitol Steps

- Cook Political Report

- Crooks and Liars

- Daily Kos Comics

- Daily Show

- David Horsey

- Derf City

- Digby

- Eclectablog

- Electoral Vote

- Fair and Unbalanced

- Fark Politics

- Five Thirty Eight Politics

- Funny or Die

- Funny Times

- Go Comics

- Hackwhackers

- Heather Cox Richardson

- HuffPost Comedy

- John Fugelsang

- Kung Foo Monkey

- Last Week Tonight

- Margaret and Helen

- Mark Fiore

- Matt Davies

- Matt Wuerker

- McClatchy Cartoons

- News of the Weird

- O'Carl's Law

- Politicususa

- PolitiFact

- Propaganda Professor

- Raging Pencils

- Randy Rainbow

- RCP Cartoons

- Saturday Night Live

- Slowpoke

- Stonekettle Station

- Ted Rall

- The Nib

- The Onion

- Tom the Dancing Bug

- Tom Toles

- USN Political Cartoons

- What Now Toons

-

Tags

Abortion Bush Campaign Finance Cheney Climate Clinton Congress Conservatives Corporations Corruption Deficits Democrats Drugs Economy Education Election Elections Energy Environment Fox News Gays Guns Health Immigration Lies McCain Media Middle East Obama Palin Protests Racism Religion Republicans Romney Spying Supreme Court Taxes Tea Party Terrorism Terrorists Torture Trump Unemployment War

-

Archives

You are Visitor #

12 Comments

i’m an american now living in sweden, but I still follow US politics. Viewing it all from the outside, especially from here, gives it all a new perspective for me. Here, you actually see where your taxes go, so entitlements are protected and not used as a political football. Swedes look perplexed at the idea of holding entitlements hostage over increasing top rates from 35% to just 39% (top rate here is 57%). While they still have plenty that needs reforming here, you’ll know that it’ll eventually get done while keeping the entire society in mind. A pure social democracy.

love your blog!

Sweden always comes out tops in social welfare. And with global warming, we should all move there.

Here here!

I meant there, there!

idk about this…I kinda agree with the republicans a bit. If we look at two of the core ideals for each party what do we have, republicans anti high tax and democrats are for social programs. Democrats cannot ask republicans to cave on their ideal a bit without the democrats caving on theirs and vice versa. It is only fair and the only path to good solid compromise

Duckman, Republicans are not offering any compromise, only more of the same. They are still saying that they will not agree to any actual tax rate increases, only the closing of loopholes. Mathematically, there are not enough loopholes to close to get rid of the deficit, so the only option is to make dramatic cuts to SS/Medicare/Medicaid (what they are calling “entitlement reform”, and cuts to other programs that will seriously cripple our economy.

I can’t even agree with your argument. Republicans, under Dubya, pushed through Medicare Part D (which was a huge unfunded giveaway to the drug companies), not to mention starting two wars. Their sudden desire to cut spending (once Obama was elected) is ludicrous.

On top of that, Obamacare made some reforms to Medicare, by lowering costs while not lowering benefits. How did Republicans respond? They went crazy, screaming that Obamacare cut Medicare by $720 billion, and claiming that they would never cut Medicare. But now they are insisting on Medicare reform to save money?

Give me a freaking break.

yes, GOP is “anti high tax” but they need to get out of the bubble and look around. 39% is not high tax in comparison to other countries, especially for millionaires and billionaires. To argue the opposite just makes you look uninformed or just plain moronic. Why would anyone compromise with someone like that? Would you?

Whenever they’re asked about the fiscal cliff in interviews, GOP lawmakers always fall back on the line, “we’ll have to have an adult conversation about it”. Well friggin’ do it already!

Honestly I kinda hope they do nothing and “go over the cliff”. Yes, there will be problems, especially with many of the social cuts, but I see many benefits as well. Taxes, which do need to be raised, will go up. This includes increases in the top tax bracket, as well as taxes on capital gains, dividends, and carried interest which desperately need to be raised. Plus, there will be actual cuts to our bloated defense budget, not just lowered increases for a change.

It just doesn’t seem to be as bad to me as it is being portrayed by everyone. Can someone explain to me why I’m wrong?

TJ, the problem is that the social cuts will happen immediately, but the tax increases won’t happen until taxes are actually filed. Before then (and they have a full year) they could retroactively lower taxes back down.

Do you really want the government to have across-the-board cuts? Not just social cuts, but laying off people in every part of government — the military, food inspectors, air traffic controllers, park rangers, weather forecasters, etc. Unemployment will skyrocket, which will be really hard on the economy. So even if taxes go up (eventually) it might not even make up for the loss of revenue from people being out of work.

Yup, more of the same short-term thinking unfortunately. Fiscal stimulus can be more effective when it’s automatic. When spending to cushion economic blows happens as part of a more carefully designed set of programs, that are established during good times, it can be ready to go immediately when the economy turns for the worse. It can be designed to taper off when it makes sense economically, such as when the jobless rate has fallen below a certain rate, rather than on some arbitrary date. Plenty of other countries with much larger safety nets already do this, such as northern Europe.

Don’t get me wrong, I don’t want to see giant cuts across the board. However, I do want to see actual defense cuts and higher taxes, especially on capital gains, dividends, etc.

I don’t understand how you can invest money and then when you pull it out the extra money you didn’t have before you started is NOT considered normal income. How is that any different from the rest of the country actually working for income. I don’t begrudge successful investors their success, but I do begrudge the fact that they get a better tax rate. “To encourage investment” – what a crock! How many people have ever said “I’m thinking about investing, but I don’t want to pay taxes on all the money I’ll be making so I’ll just stick with what I’ve got.” NONE. And then we see the results — that successful billionaires are paying less taxes by percent than normal middle class people — and we don’t do anything about it?!? Ugh.

So, if you say there’s a chance that the cuts will happen on Jan 1 and the tax cuts will be delayed (and possibly avoided), then I understand that is a potential problem. However, I still feel like the rich and Republicans have a lot more to lose in this, so I would much rather see nothing done than see the Democrats cave in and give up way too much for way too little in return. They should be negotiating from a position of power finally.

My understanding of the capital gains benefit is to encourage longer term investing. Of course, that doesn’t work as long as normal taxes are so low.

EXACTLY (whoever you are)! As long as taxes are very low, you are giving the rich an incentive to keep their money. If taxes are high, they have more of an incentive to invest it.