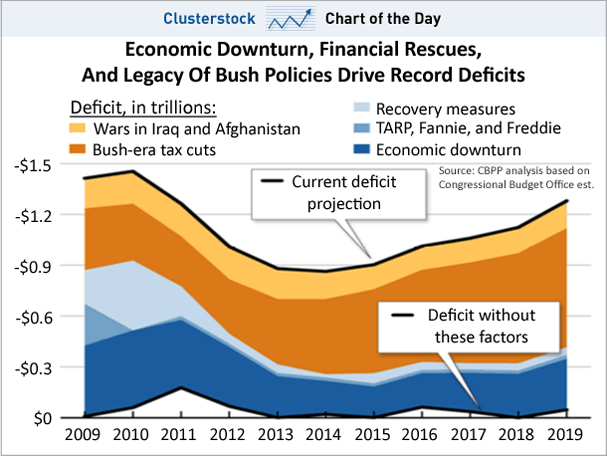

I’m getting tired of the Republicans pretending that they are serious about deficit reduction and blaming it on Obama. They keep claiming that Obama raised the deficit more than Bush, but that was only to fund the stimulus to clean up the economic mess left by Bush. And the stimulus spending has now mostly gone away. Even now, the deficit is clearly going down, with the major cause of the continuing deficits being Bush’s tax cuts, which the Republicans refuse to get rid of.

If Bush hadn’t screwed up everything, the deficit would be the black line at the bottom of the graph. The only reason Republicans are screaming about the deficit now is so they can kill virtually every single program that helps people who tend to vote Democratic.

27 Comments

This graph looks like a cross-section of America’s fault zones and coming default zones.

Thats a future ” the deficit is clearly going down” not current, so its an estimate based on numbers supplied by whoever ordered the project. Its not fact its prediction. The deficit this year has increased over last with no stimulus spending and reductions in defense spending.

I do agree with the philosophy that revenues will have to raised to fix this, along with spending cuts. Dems hate to cut spending, Reps hate to raise taxes, somewhere in the middle lies the answer.

For what it’s worth, while the graphic originated with the Center for Budget and Policy Priorities, their numbers are based on the Congressional Budget Office, the non-partisan official source of federal budget analysis. So ad hominem implications that “whoever ordered the project” produced a biased result should be avoided in this case.

Instead of a blanket statement like “Dems hate to cut spending,” I would append “without analysis and justification.” It’s not a question of cutting spending or not. It’s a question of what do we cut and by how much. I had seen a survey that asked people what federal programs they think should have budget cuts. People could select any combination of programs. The end result was that every area received less than 30% of people in favor of cutting (not eliminating…just reducing) that particular portion. The only exception was foreign aid, which received 35%, despite the fact that this part of the budget is insignificant. In the end, for any government program, you’re going to find 2/3 of people who want to keep it.

So we get back to the budget problems. If we’re going to make cuts, we have to prioritize which areas get cut and by how much. And we have to consider the impact of those cuts. We could, for instance, completely eliminate the defense budget, but I don’t think anyone would like the result. We could completely eliminate the Dept of Education, which would prevent millions of people from going to college (thus ensuring they stay in poverty). We could get rid of the National Science Foundation, killing long-term progress in this country and leading to a significant brain-drain. We could cut Medicaid, and force poor people to use the emergency room for basic medical services (thus significantly increasing costs). We can cut any program we wish, but we as a society must be prepared to accept the results.

I’m not against cutting spending, and I’m not against raising taxes. Instead, I’m in favor of prioritizing the programs we want to keep, and adjusting the revenue side of the equation accordingly.

How about the debt caused by the unpaid for Medicare drug plan? I’ve asked Senator Grassley several times about it and why we can’t use market share to drive down the cost. His consistent response is competition, even though some of the meds are exclusive property of one company.

I agree with Michael.

I’m aware the CBO is non-partisan and constructs excruciatingly accurate products. However they still base their reports on assumptions supplied by the requestor and those assumptions cannot be changed by the CBO (you supply the what if, they give you the result). We are fast closing in on spending twice what we take in in revenues. If we returned to 2008 or 2006 spending levels no one would starve, college loans would still go out, seniors would get their drugs, and life would go on. If we raised revenue by the equal amount of reductions we’d be about half way there. Then we’d just have to wait on the economy to rebound to get us close to the goal of an annual deficit that is manageable.

On the medicare part D, yes it was an unfunded liablilty, just like many of the HCR parts yet to be implemented until after the next election. Taking roughly half of medicare’s funding to pay for under senior care isn’t going to solve it. I personally believe we should have asked for an additional payroll tax like SS and medicare to pay for it to really fund it. If the Dem congress was so concerned about the unfunded part D, why did’nt they address it in the HCR bill or something separate between 2006 and 2010? The Dems had a perfect opportunity to fund both by adding the extra payroll tax, but knew politically it would cost them. It cost them anyway and it’s still unfunded.

Both sides of the isle are spinless, we need to change all of them out again in 2012, get some serious professionals who are not afraid to tell it like it is.

To piggyback on Micheal’s comment, I think that framing any changes to entitlement or other government programs as cuts isn’t always helpful. There may indeed be cuts, as in less appropriations (less money). But there may also just be changes that phase out certain functions or activities or change the criteria for benefits. Obviously, from the perspective of the person who received certain benefits, or whose job it was to do something that might not need to be done any more or could be done differently, it feels like a cut. In the overall structure of the system, it isn’t really. It is simply restructuring and prioritizing the functions that need to be done and who needs to do them.

For example I don’t think that changing the retirement age, per se, should be framed as a cut. Especially because the change wouldn’t take place for decades. I do think that there should be some flexibility in this or perhaps an occupational based retirement age criteria. A construction worker should not have to retire at 70. But someone like me could most likely work well into our 80s (academics often do).

Framing all changes as cuts looks too much like the argument that closing tax loopholes is a tax increase. It’s not accurate and doesn’t help with making difficult choices.

Also, I do think that a small part of the blame for the current economic situation lies with Clinton and the Congress under Clinton. The foundation stone for the housing bubble was laid during Reagan administration, but was built and mortared in place by Clinton and the Congresses om the 1990s. Many of the corporate tax loopholes that are part of our current revenue problem are also from that period. And, while deindustrialization started in the 1970s, NAFTA and similar trade agreements also ensured the decline of well-paying manufacturing jobs (and the industries and services that supported them).

I’m happy to blame Bush too, but let’s be fair and recognize that Obama and this Congress is dealing with a problem longer in the making than first of Bush’s tax cuts in 2001.

All for that Starluna, I dont remember where it was, but someone showed policies that helped cause the recession and you could trace the policies back to every president, all the way back to Carter. Of course Americans go the easy route and just blame the last guy, but they can all be blamed, and ya know what, the next time we are in a recession(should be this decade) you can tie it to some policy obama made. They all end up causing a problem in some way shape or form.

Well said Starluna and NO U! By the way the anonymous was also me (diff computer):)

Something we could also consider for SS/MC solvency is raising the cap above the 106k currently in place and looking at capping payouts based on non-SS retirement income.

Agree with everyone above, thanks Michael, Starluna and Patriotsgt.

The thing that makes me angry is the total hypocrisy of the Republicans. There is no way to “balance the budget” without revenue increases of some kind and every non-partisan economist (and most partisan ones) say so.

There is no way to balance it without spending reductions either. So, as everyone here as said, it requires a serious discusison of priorities and a mixed solution, and anyone that trumpets all one thing or another is just mistaken.

And to echo Starluna’s cogent point, reducing the spending on a program doesn’t have to mean benefit cuts. Both sides gloss over the idea of re-engineering to deliver the same or greater benefits for less cost, but that’s really the best approach – and there is a lot of room for that kind of improvment.

Regarding the CBO, this chart is based on the March 2010 10-year baseline prediction, which outlines how the budget will look if no policy changes. To my knowledge, the CBO baseline projections are not specifically requested by anyone, but are regularly released based on their best estimate of predicting the future economic performance. So, in this case to the best of my knowledge, no one supplied specific assumptions to the CBO. But, yes, you are correct that you can get garbage-in-garbage-out analysis even from the CBO.

As for your SS suggestions in #9, I am in complete 100% agreement with you. (That may be a first for us! Haha…) The one (legitimate) concern that people have pointed out is how that will affect the wealthy’s view toward the program. Right now, SS is designed as an insurance program (hence the I in OASDI) in which you pay into it under the assumption that you will later benefit from it. If someone pays into it their entire working life but fails to receive a benefit later on, why should they support its continued existence? I don’t really have a solution, but my view is that SS should be more of a “retirement with dignity” welfare program, ensuring that all of our elders have a baseline of financial stability. I guess one possibility would be to provide some sort of tax break (maybe a greater exemption for inheritance taxes) for those who eschew their SS benefits. I don’t know…

Another thing that would help with their solvency is to ban the federal government from borrowing from the OASDI trust fund.

Spot on Michael. On the SS it is a tough question. Your absolutely correct that if we are expected to pay in, we should get a benefit out. Perhaps the answer is in a sliding payout scale that never goes to 0, but includes the option to “opt out” of payouts. I’m not completely sold on the extending start to withdrawal age to 70, because as Starluna pointed out at one time someone in hte construction or harder labor jobs may not as easily be able to continue working as a politician or academic.

I agree on the raiding SS fund and was somewhat confused when the President stated earlier that SS doesn’t contribute to the deficit because it still funds itself, and then 2 days later said if we don’t raise the debt ceiling SS checks won’t be able to go out. Was he using a scare tactic, or is SS actually bankrupt.

I just don’t trust the lot of them. When washington says you can trust us, I say sure just ask an Indian.

Yes, extending the start age to 70 seems to penalize those who need SS the most — people who have worked physically demanding jobs who probably can’t work past the age of 65 (if that long).

As for your question, PatriotSgt, saying that SS doesn’t contribute to the deficit (because it brings in as much money as it pays out) and saying that SS checks would not be mailed out if the government runs out of money is completely consistent. Just because a program pays for itself doesn’t mean it won’t be affected by a shutdown — the SS funds and the general funds have been co-mingled for a long time. Besides, if there is a government shutdown, who would mail out those checks?

I also don’t like it when people say “You can’t trust government”. That seems to imply that you can trust someone else more, like corporations? Hardly.

Psgt – the apparent dichotomy in the “SS doesn’t contribute to the deficit” and “SS checks may not go out” actually is completely logical and both are true.

The SS trust fund was looted by prior Congresses and basically doesn’t exist. But right now and for the next several years, the rate of cash in from current contributions is greater than the rate of cash out in checks. That doesn’t remain true over the long term (when all the baby boomers retire it goes negative), but it is true today. So SS isn’t part of the “deficit problem” because it is funding itself.

That said, if the government was to actually go into default then they would have to decide how to spend the money they actually have coming in. And that means for everything – including SS. So in the default scenario, no one can “guarantee” that all SS checks will go out because they might have to pay something else – like, for example, the active combat operations, the payments on the debt, active medical treatments, etc.

It was a little bit of a scare tactic from the standpoint that most politicians would make SS a high priority and so it *probably* would continue without interruption, but all the default scenarios are so bad it cannot be “guaranteed”. And, of course, that is actually what Obama said – not that “we will stop paying social security” but “I cannot guarantee it.”

DTA – Dont Trust Anybody

Arthanyel – I keep forgetting the government doesn’t operate like a business, at least my small business. When I get funds targeted for a specific purpose, its hands off. For example when my tenents give me security deposits its their money unless there is a deficiency at lease termination. So those collections remain in a separate account in my business model and don’t get touched until the tenent leaves. Too bad the government doesn’t operate the same way.

NO U- i like that DTA

IK – I trust you 🙂

Also – as I understand if we don’t raise the debt ceiling the government won’t necessarily shut down, just some debt owners like China might not get paid their interest and some non essential programs would go on hold. We’d still be able to pick and choose what goes on and what doesn’t. As I understand the deficit for Aug is around 150billion so everything else would be funded but that amount. I do fully understand the negative implications in the credit and bond markets. I was glad that Mitch at least offered a solution for Obama to be able to raise the debt temporarily without congress approval to separate the budget political fight from the nations immediate financial solvency issues.

Anonymous – just out of curiosity, do you keep the security in escrow because it is a good business practice, or are you also required to do that by local ordinance? Here in Boston, such good business practices had to be enshrined into law because there are too many bad landlords or landlords who make bad decisions out there.

I don’t quite understand McConnell’s proposal. As I understand it, the proposal is to allow the president to decide whether to increase the debt ceiling. Isn’t that just de facto increasing the debt ceiling? It just strikes me as a way to try to weasel out of responsibility for increasing the debt ceiling. They can try to pin the increase on the debt ceiling on Obama even though they gave him permission to do so.

Yeah, it is a way for the Republicans to blame the rising deficit on Obama. It is a standard tactic for Congress on a number of issues (declaring war being one of them).

Yeah, SS payments used to be held in the proverbial “lockbox” until Congress raided it and converted excess FICA taxes collected into normal revenue. Even so there still is a SS trust fund, and SS continues to take in more money than it pays out. This will change probably in 2015, but even after that the trust fund will continue to grow (probably until 2025) because of accruing interest. Depending on whose projections turn out to closer to reality in the future, the trust fund will last until 2042 (SS administration numbers) or 2052 (CBO numbers). Of course, if the economy does better than predicted, it is even possible that Social Security could remain solvent forever.

Starluna – I do it becasue its a good business practice not becasue I’m required to. Unlike the gas revenues and teacher pension money that have been collected in our state to fix the rodes retire teachers and somehow found there way into the general fund….never to be seen again 🙁

I think your right on the political aspects of McConnell’s proposal. But, I do think it’s a gesture that might not work out badly for Obama. He’d likely be seen as the adult in the room and also displace the criticism the repub leadership would get for giving away their leverage who might be trying to distance themselves from the tea party and presidential race mud-wrestling.

3rd computer in 3 days. I keep forgetting to put my handle in there.

Anonymous: “. . . as I understand if we don’t raise the debt ceiling the government won’t necessarily shut down, just some debt owners like China might not get paid their interest and some non essential programs would go on hold.”

Unfortunately not true. The deficit is approximately 150B for August as you say – but committed spending is 366B. Even if you shut the entire governmment down, laid off every federal employee, and suspended every discretionary program – not just “non-essential” programs, but EVERY program, and only paid the debt payments, the military, Social Security, and Medicare reimbursements for treatment already incurred, you would STILL be short on the order of 75 billion dollars.

Not raising the debt ceiling isn’t like choosing not to go to Starbucks because we don’t have the budget. It is setting fire to the house because we can’t pay the mortgage, and then having to live homeless because all the fire insurance payments have been suspended.

According to the AP:

“…Senate Republican leader Mitch McConnell defended his ‘last resort’ plan against conservative critics, saying it was the best way to protect Republicans from being associated with economic hard times. ‘I refuse to help Barack Obama get re-elected by marching Republicans into a position where we have co-ownership of a bad economy,’ McConnell said on a radio talk show, contending that letting the nation go into financial default would give Obama reason to blame Republicans for the negative fallout.”

http://www.boston.com/business/articles/2011/07/13/debt_talks_grind_on_clock_ticks_toward_default

And there you go.

PatriotSgt – state legislatures are probably worse than Congress in raiding dedicated funds. They did that in CA in the early 1990s to balance the state budget which basically threw all of the counties into deficits almost overnight. LA County ended up closing or selling hospitals and health clinics as a result. I don’t expect government to behave like a business and there is a good argument that they shouldn’t. But I do expect them to be fiscally responsible and there is nothing responsible about raiding the trust funds.

Starluna, that article (and the quote from McConnell) is amazing. So the Republicans are no longer even pretending that they care about the country, they only care about pandering to their base (or at least not being able to be blamed by their base for anything).

Makes me sick.

I do wonder, though, how much of their “base” sees this as the pandering that it is. McConnell is essentially saying that he would do something different (perhaps even the right thing) but he doesn’t want to have to deal with the people who apparently believe that highways are maintained by leprechauns and their national park bathrooms are managed by forest fairies.

Starluna – LOL.

I am hoping that as a result of all of this the GOP finishes fracturing into the wing nuts (like Bachmann) and the conservative-but-not-stupid ones. The “base” that Sarah Palin and Bachmann fire up are the crazies controlling thr primaries.

We have to change the system so that rational human beings are viable candidates and extremeist fringe nut jobs (on both sides) are left outside where they belong.

LOL @ the forest fairies

I agree with your assessment of McConnell’s possible position and think that Arthanyel is pretty close as well on the “but-not-stupid” GOPers vs the outright crazies. McConnell might also be stepping up for Boehner who seems to have lost control of things in the house.

Wow! Busy thread today!

I wanted to add one more comment about proposed tweaks to SS, specifically the plan to raise the minimum age to 70. The justification is that the average lifespan is increasing, and this change helps to reduce the costs…except the average is not universally increasing. Among the poor and working classes, average life expectancy has pretty much stayed constant. The increase has primarily been observed in the upper socio-economic segments.

I’ve heard it put this way: Raising the SS collection age to 70 is, in essence, asking janitors to work a few more years because lawyers are living longer.

Michael – spot on.